-

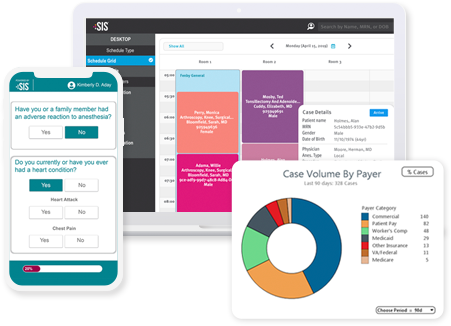

The Connected ASC: Interoperability in Action

ASCs can leverage interoperability to enhance their efficiency, reduce cost and errors, strengthen productivity, and more. Learn how your ASC can optimize its use of IT and maximize its technology investments.

Where's My Money?!? ASCs' Path to Payment SIS' revenue cycle experts highlight common challenges ASCs face in collecting payment and share guidance for ASCs to collect what they are owed and better ensure no money is left behind.

Where's My Money?!? ASCs' Path to Payment SIS' revenue cycle experts highlight common challenges ASCs face in collecting payment and share guidance for ASCs to collect what they are owed and better ensure no money is left behind.