Following a recent webinar presentation on "Days to Bill: Optimizing This Critical Key Performance Indicator," Jho Outlaw, senior vice president of Revenue Cycle Services for SIS, and Jessica Nelson, director of Revenue Cycle Services for SIS, fielded questions from participants. Here are those questions, along with Outlaw's and Nelson's responses, summarized for readability.

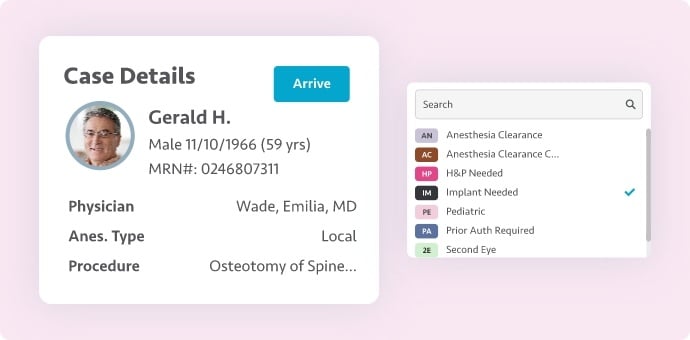

Q: Approximately half of my ASC's cases include implants, and I have to wait on the vendor to provide the invoice to bill out for these implants. What have you found to be best practice when implants are involved and holding up your days to bill?

A: Implants and their invoices are big contributors to a possible slowdown in an ASC's days to bill. What we recommend with our ASC clients that have a high percentage of their cases involving implants is to take a look at payer contracts and payer-specific guidelines to determine which payers actually require invoices for claim submission. You may find that you don't necessarily need to wait for the invoice if you already have some type of inventory or pricing spreadsheet or another form of documentation that your billers can refer to when billing implants. This may be a very good starting point to reducing your days to bill for those invoice requirements.

Q: How do some ASCs get their bills out on the same day or the day after service being rendered if the coders are required to wait on documentation?

A: Most of the time, those centers are performing lower-acuity cases, such as single-specialty ASCs focused on ophthalmology or gastroenterology (GI). When these centers have very organized processes for documentation, then it is possible for documentation to be turned around quickly enough for a coder to review it, recommend the diagnosis coding, CPT coding and charges, and then for a biller to get those charges entered and billed out the door. This is one of the reasons you may have a different days-to-bill key performance indicator (KPI) for one service line versus another, and why it is important to drill down for each of your particular services and decide what is its KPI.

With all of that said, even if you are using certified coders, it is nearly impossible to get a bill out on the same day. The second day — i.e., the day after a case — is doable for some cases when documentation comes right back and there's no research necessary.

Most of the time, we see an average of three days and consider that recommended practice. Trying to "force" this figure lower could lead to the cutting of corners, such as coding without documentation by guessing what will be in the documentation.

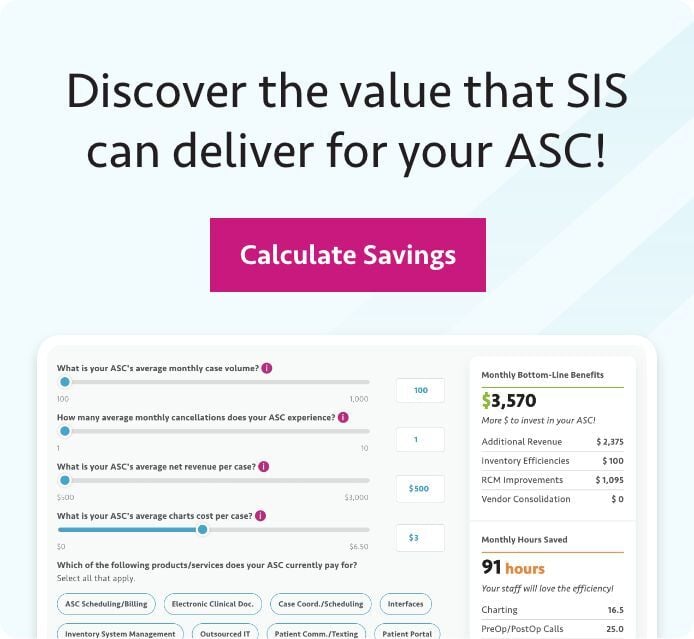

Q: Is there any general information about how many billers you should have related to your case volume?

A: The short answer is that it differs with every situation. You need understand and be able to set expectations for the number of hours that must be worked to effectively complete the job.

Look at your number of cases, complexity of service lines, and complexity of payer mix. All of those are important factors. More complex situations will require more time and thus more billers. What can bring this figure down are factors such as high percentage of Medicare since it's a more straightforward billing process, only contracting with one or a few private payers, little to no out-of-network, little workers' compensation, little liability, and physicians who are very good at documentation.

Q: One of our biggest private payers audited us last year and is now taking much of our money. They claim that many of our GI cases were billed wrong. They even took money back on some of our pain management cases. We sent the payer the records they requested on time and they say either the documentation is missing or did not match the bill. How could this happen?

A: There's a lot to process here. It seems like this payer focused on lower-acuity cases, which may be mostly what this ASC performs. What we're starting to see is that these auditors, which we refer to as "bounty hunters," have caught up with the ASC industry. Five years ago, only large acute-care health systems were attracting bounty hunter auditors. These are individuals who may have worked in the business, such as coders or nurse auditors. Payers seek these individuals out, provide them with a facility's data, and tell them that whatever money they can get back from a facility, they will receive a percentage of it.

These bounty hunters are determined to find as much money as possible to maximize their time and effort. What are they looking for? Maybe you coded prior to receiving documentation and the documentation is missing. Maybe the documentation was incomplete. For a routine GI procedure, maybe you coded it as medically necessary, but they can't find this stated in the documentation.

We've witnessed an ASC that would code its GI procedures as routine rather than medically necessary because routine was covered at 100%. The ASC would hit the patient's deductible and the patient would need to cover the entire cost. The bounty hunter might find that in your audit.

As for pain, there are a lot of reasons why you may get hit by a bounty hunter. There are many levels of pain and many levels of injections. Sometimes ASCs use spinal cord stimulators for spinal decompression. If you coded spinal decompression and the documentation doesn't clearly state that's what occurred, this could trigger a refund request.

Why are ASCs now in the audit spotlight? The bounty hunters have figured out that if they don't learn how to audit ASCs, they won't earn commissions because procedures are migrating out of the acute-care space and increasingly coming to ASCs. The bounty hunters also know that our industry hasn't been as highly scrutinized as acute-care hospitals, so they know there's an opportunity until we tighten our processes.

To address the specific situation outlined in the question, you would need to dive into your denials, what's triggering them, and what pieces of your process are being missed or completed incorrectly. It's going to take research on those denials to figure out how to keep them from occurring again.

Q: When calculating a days to bill average, do you pull your cases billed on a weekly or monthly basis? If monthly, do you start with the first day of the month or the day the new billing period is open?

A: We document the KPI on a monthly basis, but we look at this figure at least weekly. We use the billing period data/cases to calculate days to bill. This means any bills billed out in the month, regardless of date of service, are counted towards the unbilled number.