On Jan. 1, 2022, the surprise billing provisions of the Consolidated Appropriations Act, 2021 — commonly referred to as the No Surprises Act — went into effect. Daren Smith, director of ASC Solutions for Surgical Information Systems (SIS), answers some common questions he is hearing from ASCs about the new rules.

Q: Broadly speaking, what is the No Surprises Act?

Daren Smith: The purpose of this act is to help address situations where some healthcare providers were taking advantage of patients because of how services were covered.

For example, consider a patient going to have surgery at an ASC they believe to be in network with in-network providers. It turns out that while the ASC is in network, the anesthesia provider is out of network. As a result, the patient would get what has been described as a "surprise medical bill" since they thought they were receiving care from in-network providers billing at in-network rates. With the out-of-network anesthesia provider, the patient receives a bill — and these are often very high bills — at an out-of-network rate.

This was causing a lot of frustration and dissatisfaction for patients, and stories about significant surprise medical bills made the news. Lawmakers felt there needed to be some structure that could help prevent such surprise bills. While much of the attention concerning surprise medical bills has been on emergency situations — there is an entire section about air ambulance transportation in the law —the No Surprises Act applies to all providers, including ASCs.

Q: What do ASCs need to know about the No Surprises Act to comply with the law?

DS: There are a few main pieces of the law most ASCs are going to need to understand for compliance. There are some disclosures that must be supplied to patients. Those disclosures can be supplied in person, displayed in your waiting room, or provided via a link on your ASC's website. These disclosures should tell patients that they have the right to request a "good faith" estimate.

This requirement is causing some confusion and stress for ASCs. What's important to know right now in 2022 is that good faith estimates are only required for uninsured patients, self-pay patients, or patients who have insurance but do not want to submit to their insurance for their care. These are the only patient groups currently affected by these rules.

In reviewing annual ASC case data, these patient groups likely represent less than 10% of a typical surgery center's case volume. It's a small group to begin with for now. This requirement reflects the rule setting for this year only. That good faith estimate must be provided to patients within a specific timeframe based on when the case was scheduled, and it needs to include all the services that patients may be billed for by the ASC — and only the ASC.

For the future, we're watching for developments around what's called the "convening provider." The convening provider is intended to indicate wherever the impetus or start of the surgical process takes place. The law states that this convening provider will oversee gathering all the good faith estimates from all the providers that will be involved with the procedure. Thus, starting in 2023, ASCs may be required to provide the estimate not only for the facility fees but its physicians' professional fees, anesthesia fees, pathology fees if a specimen is going off to a lab, and any other fees associated with the procedure.

The debate right now concerning that convening provider is whether it's the ASC or surgeon that should be considered the convening provider for a surgery center procedure. We're watching to see how some of those rules flesh out. In the meantime, at SIS, we are taking a proactive approach and preparing for any potential development. We want to make sure we can help our users effectively gather whatever information they may eventually be required to provide to patients.

There's also giant section in the law about dispute resolution. What it states is that when ASCs present estimates to patients, centers are only responsible for the accuracy of their estimates and not the accuracy of other estimates provided on behalf of other providers involved in the procedure. In other words, a patient can't come back to an ASC and blame it if a pathology estimate is significantly off and then proceed with dispute resolution with the center. The patient would need to go directly to the pathologist or pathology group with their dispute.

The other noteworthy part of that dispute resolution rule is what can prompt a dispute resolution. This can only occur if a patient is billed $400 more than the estimate. If it's less than $400 above the estimate, then it does not qualify for that dispute resolution.

A final big part of the rule concerns requirements surrounding directories that insurance companies provide and the need for payers to ensure those are up to date.

Q: How does SIS Complete help with No Surprises Act compliance?

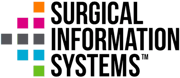

DS: For subscribers to SIS Complete, they can generate estimates out of the financial clearance tracker. Those estimates look at out-of-network benefits or self-pay patient responsibility. The workflow is already built in.

The new law has introduced some data requirements that we're working to address, but they're minor. We're making a few small changes to the estimate paperwork, including providing an ASC's National Provider Identifier (NPI). Why does a patient need that information? I do not know. Regardless, we're going to help make sure our clients maintain compliance.

Within the system, we have patient engagement protocols. This will help SIS Complete subscribers provide disclosures in the appropriate language. We will also have the ability for estimates to be provided via the portal, document that the estimates were provided within the appropriate timeframe, and capture patient acknowledgement of estimates.

Q: Do all patients need to receive estimates?

DS: That's one of the most significant misconceptions we are hearing from ASCs — that compliance is dependent upon every patient receiving a good faith estimate. But as I referenced earlier, that is not the case. In the rules, overview, fact sheets, and FAQs that CMS has published, the agency is very clear that right now, these estimates are only required for those patients who are uninsured, self-pay, or choosing not to go through their insurance.

With that said, we believe eventually that, as we see more of high-deductible plans and other factors driving up patient costs, we will probably see a push for ASCs to provide estimates to all patients, including insured patients. The good news is that when this day comes, users of SIS Complete should not need to do much more work. But for now, the requirement is only affecting that small group of patients.

Additional No Surprises Act Resources

To learn more about the No Surprises Act and how it affects ASCs, check out these resources:

- "Provisions Related to Surprise Medical Billing Become Effective in New Year" (via ASC Focus)

- "Understanding the New Surprise Billing Regulations" (via The Advancing Surgical Care Podcast)

- "The No Surprises Act is in effect. What physicians need to know." (via AMA)

- Overview of Rules & Fact Sheets (via the Centers for Medicare & Medicaid Services)

- Frequently Asked Questions About Consolidated Appropriations Act, 2021 Implementation - Good Faith Estimates (via CMS)