Ever heard the phrase, "You’re only as strong as your weakest link?" Taken literally, that’s the amount of physical force you need to break a metal chain; and you're not likely doing that at work every day. Metaphorically, it could translate to your entire revenue cycle – and how strong (effective) you’re able to make it.

Ever heard the phrase, "You’re only as strong as your weakest link?" Taken literally, that’s the amount of physical force you need to break a metal chain; and you're not likely doing that at work every day. Metaphorically, it could translate to your entire revenue cycle – and how strong (effective) you’re able to make it.

Like most service-based functions in an organization, revenue cycle management relies on people. And each of these people and their respective roles – from the person who receives claims data, to the collector who keeps their eye on obtaining payment – matter as much as all the others. Building and maintaining a healthy revenue cycle requires a team effort from start to finish. And there’s no "I" in team (or in revenue cycle management, for that matter), so finding the right mix of personalities and potential is vital.

So, how do you build the best revenue cycle management team possible? Here are three steps:

1) Choose the Right People

The success of your team relies largely on the people you hire. The characteristics of those individuals should align with the personality traits best suited for each position. From the rule-abiding Gatekeeper to the diligent Charge Poster and fearless Collector, each member of your revenue cycle team has a defined role, but will tackle it in a way that is linked to their predominant work style. You can correctly match the personality and the position with a little digging and smart questioning.

Animal personality type profiling, for example, is a fun and effective way to get a sense of who your team is – and what four-legged traits they should have to do their jobs effectively. But remember, they need to be able to work together as well; overall team chemistry is essential to the mix.

2) Hold Your People Accountable

With so many people involved in the revenue cycle management chain, it’s crucial that each of them understands their specific responsibilities. Without these roles clearly defined for every link along the chain, your processes could be highly inefficient; or worse: you could miss out on collectible revenue. An employee should understand the mechanics of their specific job as well as how it fits within the structure and goals of the organization. After all, revenue cycle is objective – the numbers clearly tell you whether you’re doing well or not. But if you don’t uphold that objectivity – and most importantly, accountability – for all roles, the chain falls apart.

3) Measure the Results

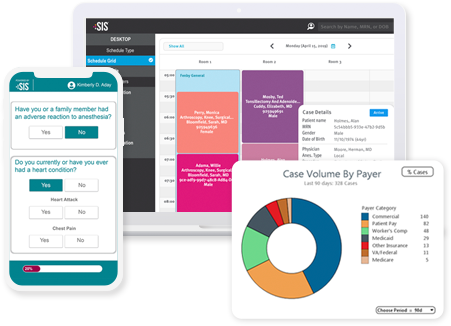

Another way to make sure your team is held accountable for their work: track and communicate the results. It's one thing for people to understand their role, but actually seeing data on how well they are performing specific tasks will help you assess what is (or isn't) working. We've already addressed how analytics can provide pertinent information about your revenue cycle – like how quickly bills get out the door. Now is the time to use that information to identify and commend employees who are excelling at their job or to figure out where the chain is broken and help fix it.

People are the backbone of any business, but it takes the right mix of people to make an organization successful. Finding that combination is key in building a strong team and healthy revenue cycle. And when responsibilities are clearly defined with accountability in place you can go even further, empowering employees to take ownership of their respective roles and work together toward achieving the highest results. Because nobody wants to be considered the weak link.

What approaches do you take to build a strong revenue cycle management team?